This story first appeared at MJBizDaily.

Sales of CBD-only products at recreational marijuana retail outlets have been falling since 2018 in four Western states as more of these goods move into mainstream stores and online, according to an analysis of sales data from Seattle-based Headset.

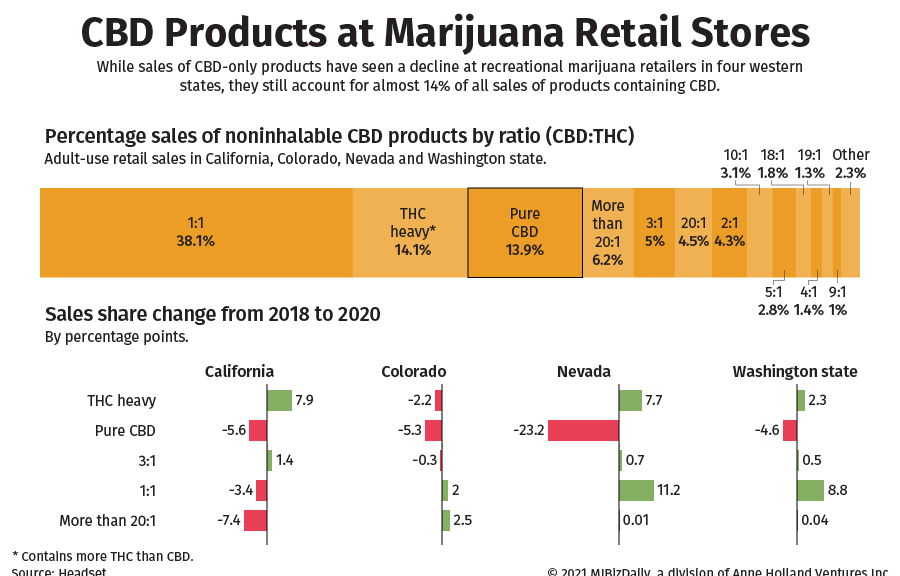

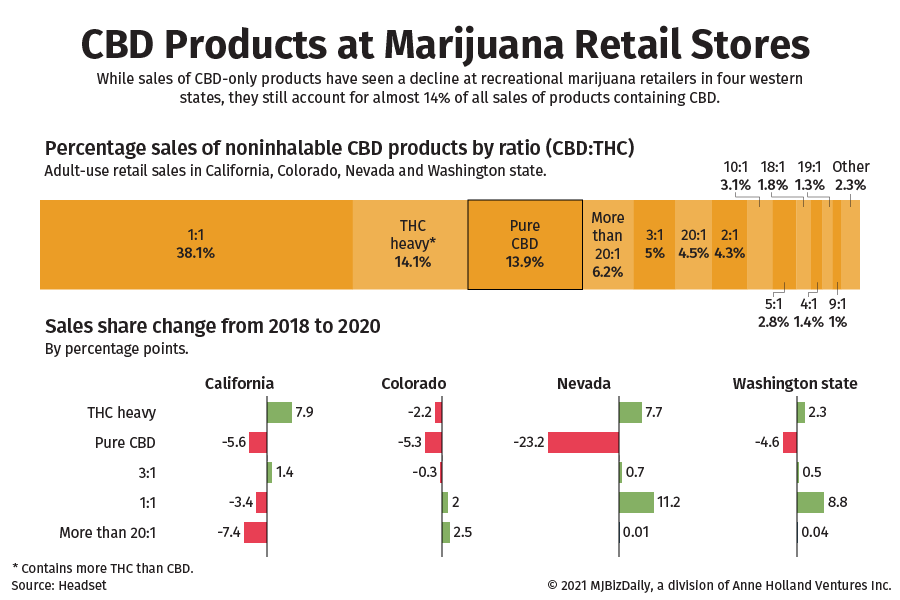

The market share of noninhalable pure CBD products in adult-use stores has declined around 5 percentage points each in California, Colorado and Washington state between 2018 and 2020, with the share of overall sales in Nevada tumbling 23 percentage points.

The expansion of CBD-only products in everyday retail, including grocery, drug and specialty stores, along with the growth of CBD in e-commerce is most likely responsible for the decline.

Still, CBD-only products accounted for almost $43 million – or 10% of all noninhalable CBD sales – at marijuana retail stores in the four states in 2020.

According to the most recent data, combined sales of all CBD products for recreational marijuana retailers in these states was nearly $42 million for May 2021, a 110% increase from May 2018.

The market share of noninhalable products containing CBD varied between 29% to 36% for May 2021 in the four states.

[table id=25 /]

One brand experiencing growth in products with a mix of CBD and THC is Colorado-based producer Wana Brands.

Wana products can be found in Canada and 11 markets across the U.S.

“We’ve seen that the rise in popularity of ratio products is really a factor of more experienced consumers being able to identify what effect they are seeking,” Eric Block, the chief revenue officer for Wana Brands, told MJBizDaily via email.

“More mature markets have more sophisticated tastes. As consumers become more experienced with cannabis, they begin to evolve their own consumer preferences.”

Block said the company really began to understand the importance of expanding beyond THC-only products in the past several years and has been adding several ratio SKUs to the market, including 1:1, 2:1, 5:1 and 10:1.

In 2020, products with an equal ratio of CBD and THC were the most popular with marijuana consumers, accounting for 38% of all CBD sales in the four states, according to the Headset data.

THC-heavy products – or those with more THC than CBD – were responsible for 17.8% of sales at recreational shops last year.

Products containing a high ratio of CBD also were popular.

Beverages, edibles and other noninhalables with 10 parts CBD to 1 part THC or more brought in 15.4% of overall CBD sales at adult-use shops in 2020.

Smaller, more conventional ratios such as 3:1 and 2:1 combined accounted for almost 11.2% of sales.

That said, product sales by category varied in each state market.

THC-heavy products were far more popular in California, accounting for 21% of CBD sales last year, whereas sales of those products barely exceeded 7% in the other states.

In Nevada, pure CBD products accounted for 41% of sales at adult-use stores in 2020, while that number hovered below 15% in California, Colorado and Washington state.

Market differences, including product availability, regulations and local taste were reflected in product growth or decline in the past two years.

High-THC products have increased the share of over overall sales in California, Colorado and Washington state since 2018.

California, meanwhile, experienced a 7.4 percentage point drop in high-CBD-ratio products during that time. But the state saw an increase of almost 8 percentage points for products with more THC than CBD.

By contrast, the market share of THC-heavy CBD products in Colorado has declined 2.2 percentage points since 2018, while equal-and high-ratio CBD products increased.

The share of sales of products with equal amounts of CBD and THC grew the most in Nevada and Washington state at 11.2 percentage points and 8.8 percentage points, respectively.

Wana Brands’ Block believes such products will evolve even more over time.

“I believe the use of ratio products will continue to grow,” he noted.

“As consumers have more experience with cannabis, they’re going to find out how they can create a more balanced experience with CBD, but THC-only products will definitely continue to exist.”

Andrew Long can be reached at [email protected].