Entrepreneurs in the young hemp industry are often still working to develop consistent processes for handling the production flow of their goods and services, from their raw components to the end product.

Developing a stable framework helps companies efficiently control product quality, inventory levels, timing and expenses to quickly deliver high-quality, consistent products to the end user.

The good news is that hemp operators can use the latest best practices to set up a seamless supply chain.

Consider the needs of a hemp or CBD retailer.

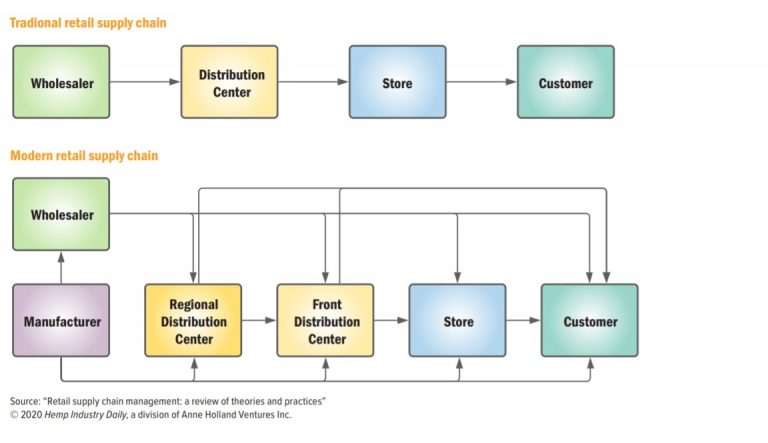

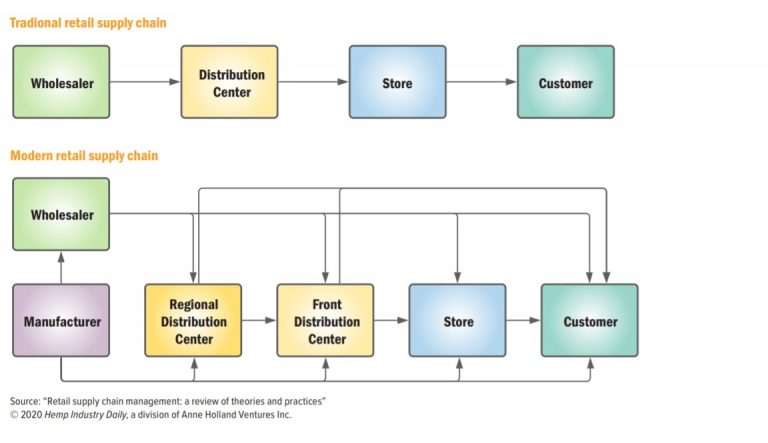

Traditionally, retailers haven’t been concerned with manufacturers and their suppliers further up the supply chain. Today’s retail supply chain, however, is much more complex. Retailers are not only tasked with expanding their network of warehouses and stores, but they also have more options for acquiring products to meet consumer demand—namely via closer partnerships with manufacturers and raw-material suppliers to create store brands or private labels.

The versatility of the hemp plant and diversity of hemp-derived product offerings provides specialty retailers and those in the general consumer goods market with a wide range of options. It also means several considerations for managing the supply chain.

Retailers need to consider a number of factors, both internal and external, when they plan and stock their inventories.

Identifying demand

The most basic role of holding inventory is to help supply meet demand. To achieve this, a retailer must first understand what products its customer base is demanding.

Traditional retailers hold the majority of their inventory in distribution centers or in stores, so the ability to get product to where it needs to be when it needs to be there is a critical consideration.

When it comes to hemp-derived ingestibles containing cannabinoids, shelf life and potency are major inventory concerns for retailers. As a result, retailers might want to establish a more direct communication line to manufacturers to ensure the most complete and accurate information regarding the products.

Sourcing

As retailers decide how to source the products on their shelves, the challenge of accurately evaluating product quality can loom large. Retailers face the burden of choosing the products they believe will appeal to their target customers, which can be a challenge in the saturated CBD market.

“Retailers are getting inundated with 3,000 companies plus who are trying to say, ‘Well, my product’s the best,’” said Annie Rouse, the Kentucky-based co-founder of CBD e-commerce platform Anavii Market and chief operating officer of hemp formulations company OP Innovates. “Well why is it the best? Are you manufacturing it in proper conditions? Are you getting the lab tests that you need? … It comes down to the retailer being able to ask the right questions.”

A retailer that invests in sourcing quality products is also investing in customer loyalty, Rouse added.

“If you’re buying a product just based on margin, but … it tastes bad or the functionality of the bottle or packaging is lacking, that customer is not going to come back and buy it again,” she said.

Suppliers should seek input from retailers when deciding how to formulate or package their products and provide samples or third-party reviews of their products. If the retailer is local, suppliers can offer to personally meet in person on store premises or invite potential buyers for a tour of the grow or manufacturing facilities.

Sales strategies

Because the hemp and CBD industries are so new, retailers are still experimenting with merchandising displays and in-store placement.

The newness of the hemp industry also means that consumer misconceptions and confusion abound. The burden of consumer education often falls to the retailer, especially for those selling hemp-derived products.

“There are a lot of myths about cannabis science, how cannabis works or just overstatements that distort the things we have demonstrated scientifically or know to be accurate,” said Anna Symonds, a consumer educator at East Fork Cultivars in Oregon.

Symonds, who has visited stores across Oregon and hosted webinars to educate retail staff directly, is adamant that salespeople should be the focus of a CBD-education campaign.

Some ways that suppliers can help their retailers with education include:

- Arrange calls or visits with specialty retail staff to educate them on product formulation, function and intended uses.

- Incorporate QR codes, leaflets and graphics on product displays to address common questions.

- Work with retailers to understand their consumer demographics to target the educational materials more effectively.

In the absence of a highly trained sales associate, well-designed and strategically placed retail displays can serve a dual function: maximize a retailer’s sales while also setting one brand apart from the competition, according to Jim Hollen, the president of Rich Ltd., a point-of-purchase display and retail store fixture company in California.

Prices and margins

According to data from Nielsen Global Connect, consumers spend an average of $75 per year on hemp-derived CBD products. However, many purchasers are still in the trial phase, which translates to a longer purchase cycle, especially for capsules, topicals and tinctures.

Hemp-CBD product prices are already compressing, driven by eroding prices for hemp biomass and plans to reach consumers with less disposable income in response to soaring unemployment numbers amid the coronavirus pandemic.

In April 2020, the aggregate price of hemp-CBD biomass plummeted to $8.10 per pound—a drop of 79% compared with $38 per pound one year earlier, according to pricing and tracking agency Hemp Benchmarks in Connecticut.

The falling CBD prices show up in direct sales faster than through mass-market retailers, according to Nielsen. Tracking prices for roughly 2,500 CBD products in food, convenience and drugstores revealed an average product price of $20.69 in a four-week period ending June 13.

Retailers have lower margins than do CBD manufacturers that sell directly to consumers. This means they have less flexibility to reduce their prices when inputs up the supply chain become cheaper. Brands that heavily discount their products when selling directly to consumers on their own e-commerce sites will ultimately be less attractive for a retailer to carry.

To read the full report, “Developing a Reliable Supply Chain for Hemp Businesses,” click here.