After spending years as a niche item in specialty stores, CBD-infused products have found their way onto the shelves of prominent retailers – and the ingredient’s presence and availability may yet increase.

This week, CBD companies announced a number of new distribution deals. Consider:

- Southeastern Grocers joined the CBD category, announcing it will begin selling a range of 65 CBD products at 152 Winn-Dixie and Bi-Lo supermarkets in Florida and South Carolina. The grocery chain will carry topicals, supplements and pet products from Charlotte’s Web, PlusCBD Oil, Medterra, Veritas Farms, Sunsoil, Irwin Naturals and Harmony Hemp. With 570 stores in seven states, Southern Grocers said it will consider expanding distribution of CBD products into additional locations in 2020.

- In its largest distribution deal to date, Straight Hemp of Arvada, Colorado, said it will sell its CBD oil and topical products in 57 Earth Fare health-food stores across 10 states from Ohio to Florida.

The 2019 Hemp & CBD Industry Factbook shows the tremendous strides CBD products have made in entering the mainstream retail market since passage of the 2018 Farm Bill.

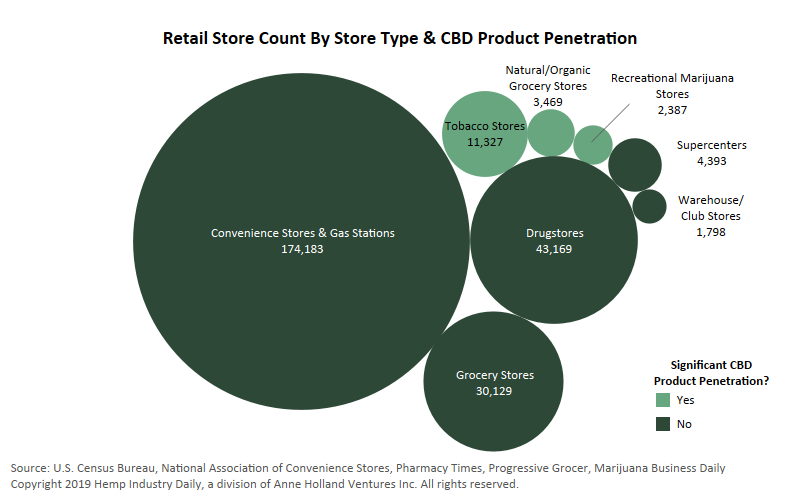

A year ago, CBD products could be found only in a small number of specialty stores, including tobacco shops, recreational marijuana retailers and natural groceries.

But after hemp was removed from the Controlled Substances Act in the 2018 Farm Bill, CBD began to appear on a variety of mainstream retailers’ shelves, such as traditional grocery stores, drugstores, convenience stores and gas stations.

Increased presence and consumer demand are expected to boost 2019 CBD sales by 133% over 2018 and past the $1 billion mark.

Despite CBD’s increased presence, it has yet to achieve significant penetration in the new outlets.

But even slight penetration in the convenience store or grocery realm can have strong impacts, as these channels have a much greater footprint than traditional CBD retailers.

For example, from 2017 to 2018, sales of CBD products through natural groceries and health-food stores skyrocketed 333%, to $52.7 million.

While this is an impressive figure, consider there are roughly 50 times as many convenience stores and gas stations in the United States than natural grocery stores.

Even if only a small percentage of convenience stores and gas stations began carrying CBD, the sales impact could be significant.

Some CBD manufacturers say that natural-grocery channels are getting so crowded with cannabidiol products that competition is eating into profits.

One manufacturer, CV Sciences, blamed overheated conditions in the natural-grocery channel this week when its quarterly revenues missed expectations.

Here’s what else you can learn about the CBD retail landscape from the 2019 Hemp & CBD Industry Factbook:

- Daily foot traffic through mainstream retail outlets now selling CBD dwarfs that of traditional CBD outlets: Supercenters see 25 times as many customers per day as recreational marijuana stores.

- In 2018, tinctures and sublinguals led CBD-infused product sales at recreational marijuana stores in California, Colorado, Nevada and Washington state.

- Hemp Industry Daily’s survey of nationwide hemp farmers found that a greater proportion anticipated selling their extracts to another manufacturer or processor rather than a retailer, indicating a strong secondary processing market.

The second annual Hemp & CBD Industry Factbook can be purchased here.