Women make up almost two-thirds of U.S. CBD users, according to a gender study from analytics firm NielsenIQ.

And with nearly 1 in 3 women saying they are likely to consume a CBD product in the next 12 months, cannabis brands are uniquely poised to grow female-focused categories like cosmetics and lotions in the coming years.

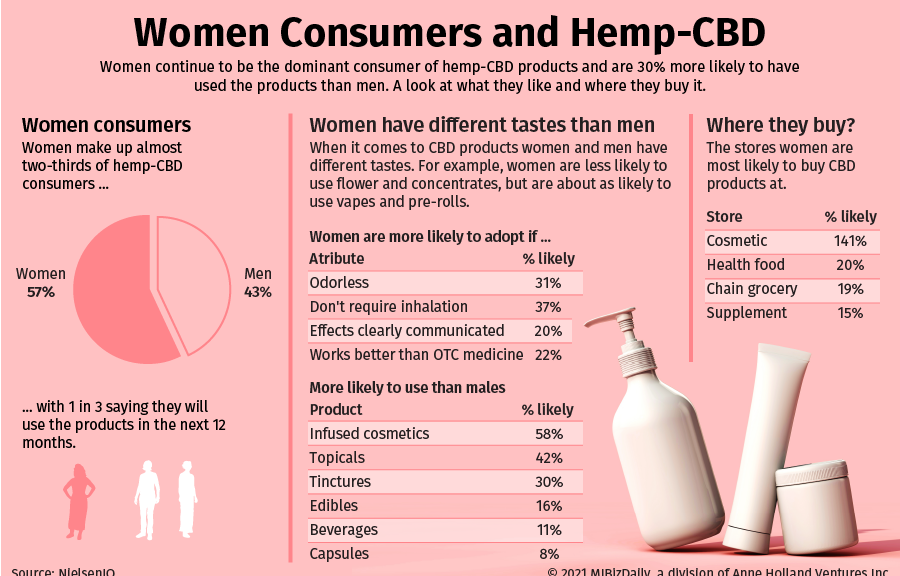

In its “Thinking Beyond the Buzz” study for 2020, Nielsen found that not only did women account for 57% of U.S. hemp-derived CBD users, but that they are 30% more likely than men to have tried CBD products.

(Nielsen tracks only hemp-derived CBD, not marijuana-derived CBD or anything sold in marijuana retail stores.)

That could be related to how men and women experience side effects.

Though only about 5% of CBD consumers reported experiencing negative side effects, female consumers were less likely than male consumers to report experiencing any negative side-effects from consuming CBD

And while CBD satisfies a variety of needs for all consumers, female shoppers are more likely to seek out skin care and conditioning treatments than men, as well as products for feminine pain related to PMS and menopausal symptoms.

Rick Maturo, Nielsen’s associate director of client service for cannabis thinks the time is right for companies to invest in women’s categories.

“There is great opportunity for brands to grow in more female-focused consumer categories like cosmetics, hand-and-body lotions and beauty-related supplements,” Maturo said.

“Companies can tailor existing product offerings to be more female-friendly in terms of flavor profiles, marketing and messaging, as well as engaging in strategic partnerships with retailers, brand ambassadors and women’s health organizations.”

The first step to do that is to understand how male and female consumers are different – and they are.

Not surprising, women are significantly more likely – 141% more likely – than men to have purchased CBD products at cosmetics store.

Beyond that, they are more likely than men to shop at heath and natural food stores, chain grocery stores and vitamin/supplement stores for CBD.

But women are less likely than men to purchases CBD products from sports stores, vape and tobacco shops, drug stores and independent grocery stores.

Maturo says there are tremendous implications from partnering the wrong format with the wrong channel.

For example, a higher priced CBD topical cosmetic product that’s targeting a female consumer is far more appropriate for a cosmetics store chain or higher-end department store retailer than a vape store or liquor store.

When it comes to online sources, women are more likely than males to have purchased from an online CBD store selling multiple brands, but they are about as likely as males to have purchased directly from a CBD brand’s e-commerce store.

Form differences

Women are more likely to use infused cosmetics, topicals and tinctures, along with edibles, beverages and capsules.

Women are more likely to adopt hemp-derived CBD products that are odorless and don’t require inhalation.

As for inhalable products, women are less likely than men to use hemp flower or concentrates frequently. But they are as likely as males to use CBD vapes and pre-rolls.

So, while brands will find more traction with non-inhalable CBD products for women they should not discount ready-to-use inhalable formats like pre-rolls and vapes.

Women are also more likely to adopt products if they are confident it will work as well or better than their current OTC medication and that it clearly communicates the intended effects.

More importantly than format, women are driven to purchase by different things than men.

Nielsen found that women are significantly less swayed by brand name, packaging and celebrity endorsements than their male counterparts.

Women based their buying decisions more on sustainability and the omission of chemicals used in the production process.

They were also more interested in having products produced from U.S. non-genetically-modified hemp.

What women use CBD for

A growing number of women are turning to hemp-derived CBD products for PMS and menstrual symptom relief.

Half of women who are likely to consume CBD in the next 12 months say that treating feminine pain is an important reason for why they will consume the product.

Aside from PMS, females are more likely to turn to CBD for pain management in general and specifically for conditions like headache and migraine-induced pain, as well as for inflammation.

Females are also more open to using CBD to improve mental health conditions like depression

Of course, feminine care, skin care and treating conditions like acne are also areas where females are more likely to seek out CBD than their male counterparts.

And many brands are taking notice.

Nielsen looked at the product landscape in the past 12 months and noticed a plethora of skin-focused CBD products come to market online and in chain cosmetics stores like Sephora and Ulta Beauty.

Even though leading CBD brands with fast-moving consumer goods chain distribution have started to release skin-focused products, there are a growing number of “prestige” products with higher price tags appearing in high-end department stores and boutiques.

Andrew Long can be reached at [email protected].